Will Anyone Buy U.S. Treasury Debt? Time For Public Deliberation

The Clock is Ticking...

The skyrocketing national debt might now seem to burden any effort to rebuild our economy, and certainly our nation seems to be running down. Inflation fueled by federal spending of our national human and productive treasure on insane, ever-more -wasteful "green" policies; escalating sanctions policies merely driving the rest of the world away from the U.S. dollar; and social malaise grips much of our culture.

What this really means is that true leadership is required, and clarity among citizens as to the steps we must take. Thoughtful Americans must be apprised of these policies now, to begin mobilizing the best within us, for tasks over the immediate years ahead [1]. Here we take up the question of the ballooning national debt.

The economic outlines of what President Trump has proposed with his Agenda47, specify a rebuild of the entire U.S. economy. What should be recognized, now, is that it is exactly such a commitment that can allow a reorganization of ballooning U.S. Treasury debt into long-term debt, to be retired as the U.S. rebuilds its leadership role in industrial production, science, technology, and a strengthened U.S. dollar.

The Debt Multiplies

It is important that we acknowledge that we are today reduced, ever more, to 'a Dollar Store with nuclear weapons.'

While it is true that many Americans depend on their Dollar Store or equivalent for bare survival, we are actually on the cusp of producing something totally new and inspiring. The Founding Fathers, led by George Washington and Alexander Hamilton, seized such a possibility before!

Let's look further at the crushing problem of our national federal debt, one comparable to that fable of The Sorcerer’s Apprentice. In doing so, we implicitly address the problem of our entire national debt, more than $95 trillion in total outstanding public and private debt across all sectors.

What is actually in the process of being happily (or grudgingly) addressed is the bankrupt concept of a "service economy." Boomers and Millennials grew up on this sophistry. It was the idea that you could have an economy without producing much of anything[2] of any real societal and physical value. We now can just throw that "service economy" in the trash can.

Thankfully, we now have the clarion call of Presidential candidate Donald Trump, calling we Americans to the task of rebuilding U.S. industry and manufacturing, to creating a physical economic "superpower." He likewise calls for building "hundreds and hundreds of big beautiful power plants" to fuel this American Renaissance. He also soberly acknowledges that this might be the last chance to save our democratic republic.

Accomplishing this task will require a dramatic shift in the composition of our workforce, done over just a few decades. Today only 25% of our workforce is employed in industrial production - mining, construction, heavy transport, energy and manufacturing; less than 10% of our workforce is employed in manufacturing. We need to produce, and we need to likewise increase the productivity and incomes of that productive workforce through advances in science and technology.

Reorganizing the National Debt

It may be surprising to many, but Trump's 2020 negotiations with Saudi Arabia, Russia, and other members of OPEC+, is a recent exercise of the traditional U.S.

state-to-state negotiations[3] now required. Throttled by the Covid pandemic, oil and gas consumption and prices dropped to negative numbers. President Trump negotiated with other oil & gas producing nations to successfully place a floor under prices. That saved the US oil and gas industries and hundreds of thousands of jobs.

The Crisis in U.S. Treasuries

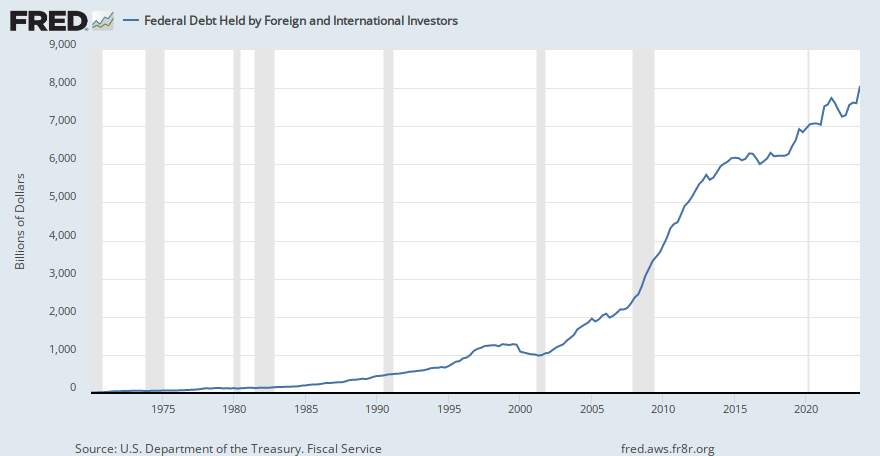

Roughly 23% of marketable U.S. Treasuries are Treasury bills with maturities of less than one year, and some 50% are Treasury notes of two to ten years, with only the remainder in actual Treasury bonds of 20 to 30 years. This is a sign of the U.S. federal government's plunge off the monetary and fiscal cliff.

Consider the increasing reliance of the U.S. Treasury on selling federal debt and ever-shorter-term maturities, while simultaneously offering higher interest rates, in search of buyers. This has thrown fuel on the hyperbolic growth of total federal debt financing. We know who ultimately pays for those interest rates and debt financing!

In addition, the U.S. Treasury must continually roll over old, outstanding debt – as current policies do not allow for the paying down of that debt. So, the U.S. Treasury is now paying much higher interest rates to roll-over debt, post-QE. (Simultaneously, there is little possibility that the Federal Reserve can now cut rates further – that is, to return to Quantitative Easing (QE) and zero interest rates to bailout the U.S. Treasury, exactly because of the consequences of that horror-show known as 15+ years of QE!

As a consequence of these two intertwined dynamics, federal debt service now exceeds $1.1 trillion in annual debt financing - and is growing fast. Federal debt service alone, not to mention debt principal, is already the third largest item in the U.S. federal budget, after entitlements and defense. This is a 'doom loop' spiraling downward, unless there is fundamental structural intervention. To understand this does not take a mastery of rocket science.

Reorganizing Our Federal Debt - A Chapter 11

The silver lining in this cloud of doom is that there is now plenty of room for a measured consideration of Treasury debt renegotiation! Ironically because most of the $26+ trillion in currently marketable Treasury debt is now held as short-term Treasuries securities, a pathway exists to refinance that short term debt as long term debt, if we are committed to rebuilding our nation as a manufacturing superpower. Under those transformed circumstances, brought into play under a second Trump administration, thirty year Treasury maturities – or even perhaps longer – would be of benefit both to ourselves and ultimately to our creditors. Indeed, seven longer bonds, including a 40-year bond, were issued between 1955 and 1963, to lengthen the maturity structure of the federal debt then.

Overseas private investors and central banks now own about 24% of all outstanding, marketable U.S. government debt, down from roughly 40% a decade ago. Foreign holdings are now in the range of about $8 trillion dollars of the $26 trillion in marketable US Treasury debt. Most of that debt is no longer held by foreign central banks, but simply other speculative short-term holdings that can quickly leave.

A Manufacturing Super-Power as Lever

It was U.S. Treasury Secretary Alexander Hamilton who re-organized the revolutionary war debt of the US government and the 13 states and ensured their successful repayment. He accomplished this through a parallel buildout of the U.S. economy, utilizing the First National Bank and national credit.

Lyndon LaRouche’s Four Laws provide a pathway out, from disaster to prosperity. Based on LaRouche’s four principles for rebuilding the economy, national infrastructure projects in energy, water, and advanced transportation systems (to move materials and products) will be built to meet tomorrow's needs. Likewise, LaRouche's proposal for a Four Powers Agreement of leading nations would involve recognition of the need for sovereign debt reorganization, ending the globalist central banking system (i.e., the modern-day British Empire).

The fact that major infrastructure investments are long term will provide stability and trust for those individuals or corporations contemplating private investment in creating the new manufacturing endeavors, and their domestic supply chains. This approach encompasses everything from large corporations to “start-up” enterprises. If such projects are also undertaken with some form of “Buy in America” guidelines and supporting tariffs, this will provide added security to those who want to participate. In essence, from a Hamiltonian perspective, such government initiatives will catalyze the creation of new companies, new projects, and new innovations.

A firm commitment to adopting such "American System" policies again, coming from a unified United States and its President, creates the basis for negotiating a reorganization of our national debt, foreign and domestic. Major nations will welcome sane American leadership, growth, and an end to globalist, endless wars. The debt is not the problem; rather, at issue now is the will to build, and build big!

[1] Even regarding trade and tariffs, an area where candidate Trump now has definite ideas for his second Presidential term, Congress retains primary authority over U.S. trade policy, through its constitutional power to levy tariffs and regulate foreign commerce. This point is made here to re-emphasize the need for a working bi-partisan majority in the US Congress (House and Senate) in support of President Trump's second term. For this to occur, the American people must be fully on-board.

[2] The “service economy” lay at the heart of the Council of Foreign Relation's 1974 "1980's Project" for "controlled disintegration" of the U.S. economy. It became the content of the Trilateral Commission's policies, including the Carter Presidency (think "de-regulation" and "de-industrialization.") Today it is the content of the globalist foundations, World Economic Forum, and sleaze like Bill Gates.

[3] The role of state-to-state negotiations is a traditional role of U.S. foreign policy, constitutionally resting in the hands of the U.S. President. Before 1970, the price of oil was fixed (at US $1.80 a barrel during the 1960s) by negotiations between the U.S. government, regional oil producing nations, and major oil companies that operated oil concessions. Subsequent events, orchestrated by the City of London, culminated in the 1973 oil price shock, as well as the eventual transfer of property rights to the oil-rich nations, changed all that.

In an earlier example, the Bretton Woods Conference, officially known as the United Nations Monetary and Financial Conference, gathered delegates from 44 nations in Bretton Woods, New Hampshire from July 1 to 22, 1944. Under the leadership of the United States, the post-WWII international monetary system was organized, warts and all. The experience of the war years had led national leaders to conclude that economic cooperation, with U.S. leadership, was then the only way to achieve both peace and prosperity, at home and abroad. Again, hardly the content of NAFTA; but more-so the content of President Trump's USMCA!

Member discussion